Deep Dive into Wedge Patterns

There is a strong bias about chart patterns and their interpretation in the technical analysis space. It is a very common belief that a rising wedge forms bearish sentiment and a falling wedge forms bullish sentiment. Is that really true and how much we can rely on such bias?

In order to understand this, we need to dig a little bit about how such concepts could have come into the picture. The best I could get on the internet is an article from Investopedia that explains a few technical reasons and constraints of using these patterns.

Through the Lens of Diagonal Waves

But, when I was studying the concepts of waves, this is what I found from one of the sources I referred to about Diagonal Waves

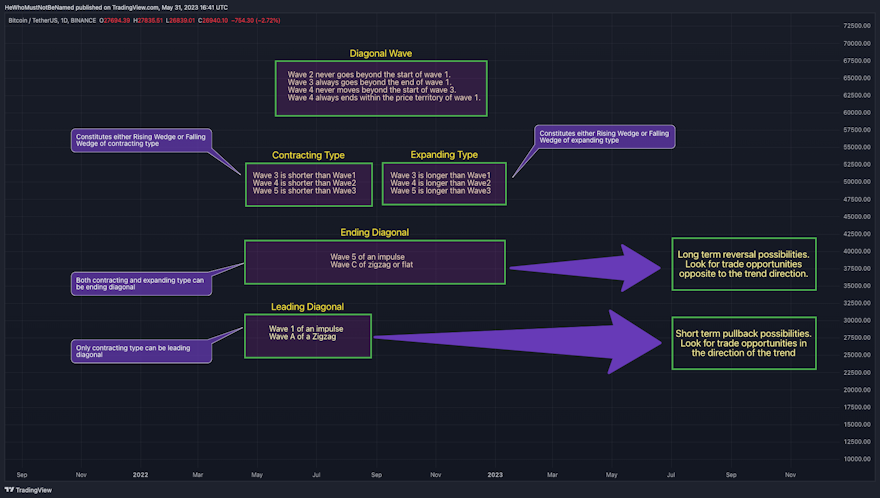

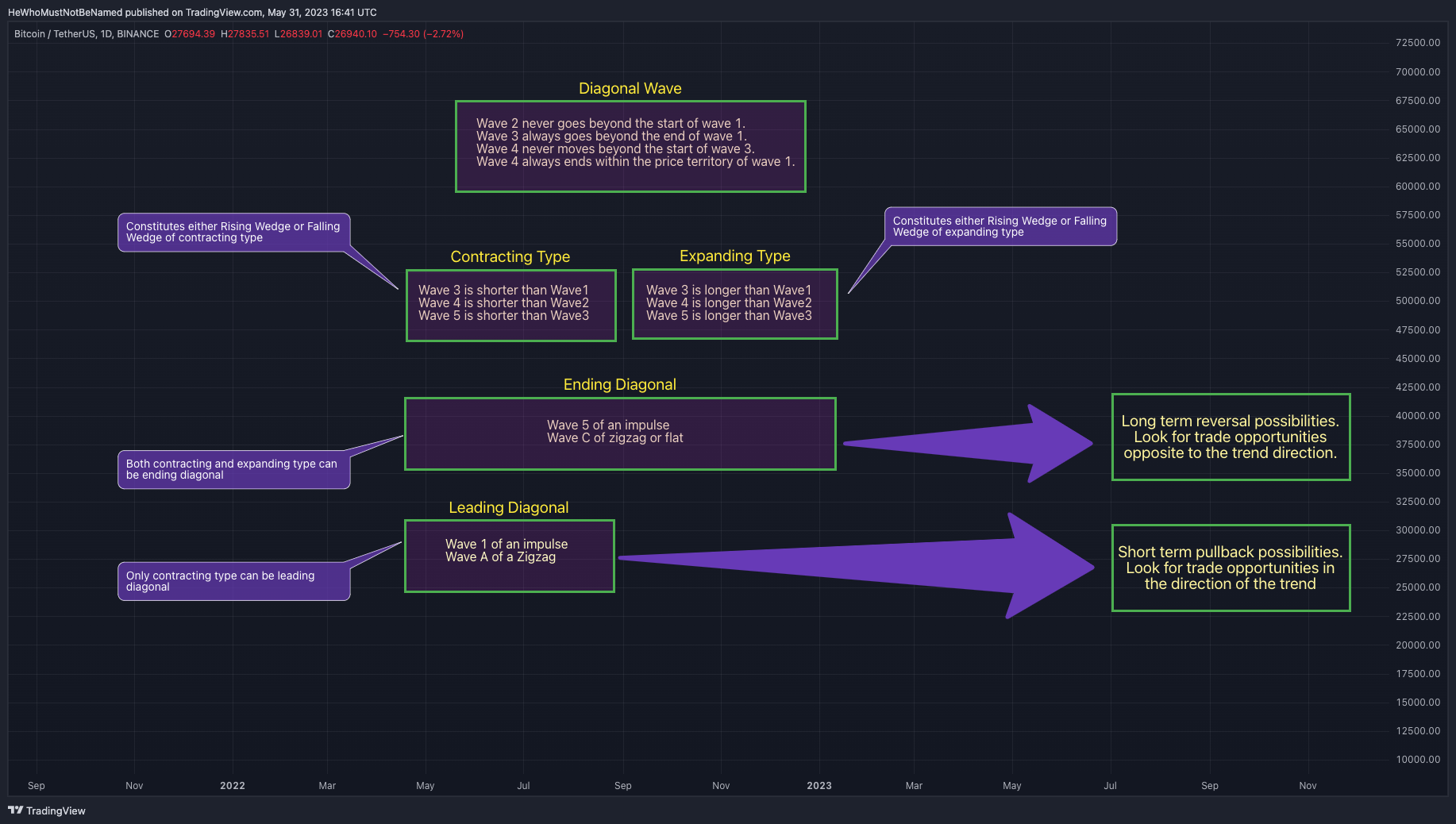

Details are summarised and explained in the below diagram

The summary here is, Diagonal waves of contracting types are the same as that of Contracting Wedge patterns. And the diagonal waves of Expanding types represent expanding wedge chart patterns.

Diagonal Waves can appear as sub-waves in multiple parts of the entire Elliott Wave. And here are our scenarios

Rules for Generic Diagonal Wave

Here are some of the common rules for potential diagonal wave

- Wave 2 never goes beyond the start of wave 1

- Wave 3 always goes beyond the end of wave 1

- Wave 4 never moves beyond the start of wave 1

- Wave 4 always ends within the price territory of wave 1

Further, the patterns are divided into two types.

- Contracting Type

- Expanding Type

Contracting Diagonal

Contracting diagonals as the name suggests lead to contracting price patterns over a period of time. Simple rules for contracting wedge formation include.

- All the generic rules of the Generic Diagonal Wave

- Wave 3 is shorter than Wave 1

- Wave 4 is shorter than Wave 2

- Wave 5 is shorter than Wave 3

Expanding Diagonal

Expanding diagonal on the other hand expands from one wave to another. Simple rules for expanding wedge formation are

- All the generic rules of the Generic Diagonal Wave

- Wave 3 is longer than Wave 1

- Wave 4 is longer than Wave 2

- Wave 5 is longer than Wave 3

Classification based on the position of the Wave

Here is another way of classifying diagonal waves and that is based on where in the higher Elliott wave pattern these formations fit.

Leading Diagonals

Leading diagonals are diagonal waves that can appear towards the start of a trend. Only contracting types can be leading diagonals.

This can be

- Wave 1 of an Impulse Wave - This is the start of a new trend. Avoid trading these wedges as they can be short pullbacks. Or better look for pullback and trading opportunities in the direction of the wedge.

- Wave A of a Zigzag Wave - This can lead to a possible bull trap or bear trap. The corrective wave is likely to continue after a small pullback

Ending Diagonals

Both expanding and contracting types can be ending diagonals. Ending diagonals are diagonal waves that can appear towards the end of a trend. Both contracting and expanding diagonal waves can be ending diagonal waves. This can be

- Wave 5 of an Impulse Wave - Meaning the trend is coming towards possible exhaustion.

- Wave C of a Zigzag Wave or Flat - Correction or pullback is coming to an end and the trend is likely to continue

Through the Lens of Wolfe Waves

Wolfe wave is a rule built on top of wedge patterns to identify time-bound targets. The idea of generating targets and stops based on the Wolfe Wave is as shown below:

Further, here are a few indicators developed in Pinescript that can help do them automatically.

Takeaways and Conclusions

Here are a few things we learnt from our study.

- When you are looking for wedge patterns on the chart, look for wedge formations created by 5 pivots. You can learn more about this from this post - Fitting Patterns to Bias

- Before trading a wedge pattern, try to identify if the pattern fits in a bigger scheme of things. Check if they are towards the end/start of a trend or pullback

- Concepts such as Wolfe Wave can help set up rules for trading wedge patterns for pullbacks.

Link to Tradingview publication: Decoding Wedge Patterns